Shingie Chisoro Dube

The entry of the app-based Uber service into South Africa’s local passenger transport industry in 2013 raises important competition and regulatory issues. Uber is a taxi smart phone application that uses the customer’s smartphone to detect their specific location using the global positioning system (GPS), and instantly connects the customer to the nearest available driver.1 Uber taxis work in exactly the same manner as traditional metered taxis in that they both take the customer to their intended destination for a metered fee. However, Uber is a technology-driven service that uses a convenient electronic taxi-hailing system to find, book and pay for taxi services. This presents an innovative new technology platform in the local taxi industry.2 In South Africa, Uber operates in the major cities of Johannesburg, Pretoria, Cape Town and Durban and is planning to expand into smaller cities. Beyond South Africa, the internet ride-sharing service has been introduced in Nairobi, Kenya and Lagos, Nigeria.3 Uber’s rapid expansion in terms of market share and geographic areas since 2013 shows an innovative new entrant that has disrupted the existing systems in the passenger transportation industry.

However, the entry of Uber into the local taxi industry was met with hostile challenges around regulations and allegations of unfair competition practices in several cities such as Washington4, Paris, Mexico City5, Lisbon in Portugal6, Bandung in Indonesia7 and Cape Town in South Africa, amongst others. South Africa’s Metered Taxi Council accuses Uber of engaging in unfair competition practices and failure to comply with local transport regulations. Metered taxi operators have alleged that Uber is using aggressive below-cost pricing and operating without metered taxi permits which are charged on an annual basis or as a once-off payment (approx. R1 500.00) according to section 54 and 62 of the National Land Transport Act No.5 of 2009.8 Uber is apparently also failing to comply with transport rules and regulations for metered taxis such as; sealed meters for the purpose of determining the fare payable, detailed description of the specific route, stipulated minimum and maximum fares per kilometer, displaying of approved rates on the vehicle and on the sealed meter, vehicle standards and safety specifications.9

Uber’s business model appears to have enabled it to bypass local transport rules and regulations including successfully adopting technological solutions to overcome local transport regulatory barriers. In response, South African regulators are currently amending the National Land Transport Act to include a new section for Transport Network Operators that caters for the regulation of operators using technology platforms such as Uber.10 Appropriate regulation, it has been argued in other countries, will lessen negative externalities and other market failures associated with this and similar services.11

On the other hand, stiff competition from the entry of Uber in places like New York, has forced traditional metered taxis to become more innovative, through the introduction of a new taxi app to compete with Uber.12 In South Africa, a new cab-hailing app called Taxify was introduced in 2015 in the main cities of Johannesburg and Cape Town as a direct competitor to Uber.13 In Vancouver, Canada; the entry of Uber forced the four main metered taxi companies to integrate and develop an eCab application in order to compete with Uber and ensure their survival in the industry.14

Comparison of metered taxi and Uber fares

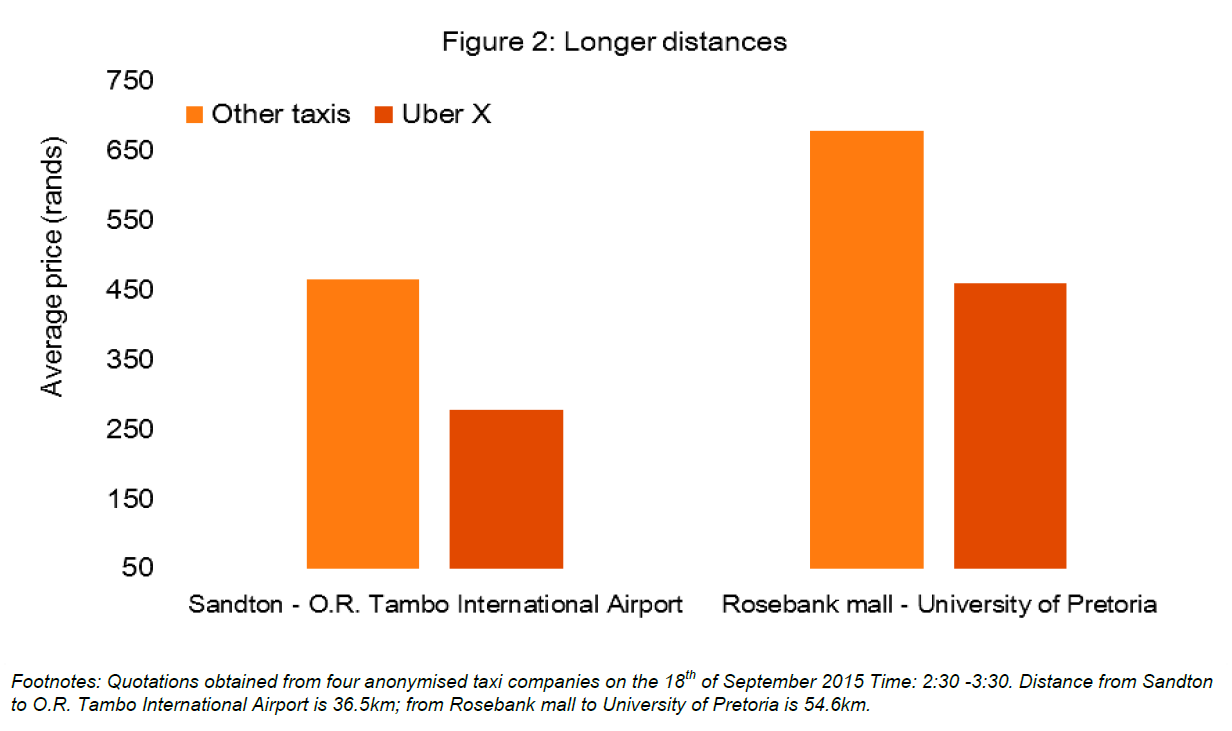

Price comparisons between Uber service and the average quoted prices of four anonymized sedan-based metered taxi companies for five different short and longer distance routes is used to assess the impact on prices following the entry of Uber into the industry. A cheaper line of Uber’s taxi offering, Uber X is used in the analysis. The routes assessed comprise a busy route from Sandton Gautrain station to O.R. Tambo International Airport, Johannesburg to Pretoria and short distances within Johannesburg. Figures 1 and 2 show that Uber is significantly cheaper than metered taxis across all distances. Metered taxis charge significantly higher premiums for short distances reaching as high as 265% above Uber X.

However, it is clear that price is not the only competitive factor driving the growth of Uber services. Before the entry of Uber, the majority of Uber customers were indifferent about using traditional meter taxis as an option. Is growing demand for Uber service purely driven by cheaper prices or is there other competitive aspects driving its rapid growth in market share? This also raises the question of whether Uber is directly taking customers from traditional metered taxis, drawing in new demand in the market, or a combination of these effects. Although metered taxis and Uber share common features they have different users and user experiences. Importantly, the growth of Uber services demonstrates the responsiveness of consumers to lower prices and improved services, and the ability for improved product offerings and prices to create benefits for not only existing, but new customers as well.

Uber has an additional convenience-based competitive advantage which allows the service to tap into a whole new market of unmet demand for convenient, fast, and flexible point-to-point urban transportation.15 The Uber application makes it easy to hail or order a cab from any location, at flexible times. Unlike Uber, traditional taxis are usually located at central depots or central places such as bus stations or train stations. In some instances the customer keeps the taxi’s cellphone number to contact the driver whenever the customer needs the service. This means that a customer needs to physically walk and search for a taxi or place a phone call to order a taxi and wait for the taxi to arrive. This process is relatively more cumbersome from the perspective of consumers. With Uber a customer simply orders a taxi right at their doorstep at the least cost with the added service to track the arrival time of the Uber taxi through a dedicated driver-passenger Uber application.16 Uber may thus be filling a ‘convenience gap’ in the market.

It is likely that the app-based service is tapping or inducing new demand of customers that were previously using their own vehicles through providing a reliable and apparently safer mode of transport that is an attractive alternative to driving. Uber is attractive for its consistent shorter waiting and travel times rendering the service more reliable than traditional taxis.17 Customers know with precision the approximated time of travel to their destinations using the dedicated driver-passenger application which tracks the entire journey.18 Uber also has a quality-based competitive advantage in terms of cleanliness and customer service standards including a rating system for drivers. The current system is that the driver’s details are sent to the customer upon ordering an Uber taxi which provides some degree of passenger security.

In terms of fares, customer requirements for a secure, transparent and easy payment system are important considerations. Uber’s transparent, standardized way of calculating fares per kilometer which is all available on the app is likely to be appealing to customers. Customers are able to request a quote for a trip before hailing an Uber taxi allowing the customer to know beforehand the cost they are going to incur.19 Uber’s ease of payment means that customers are not required to hold cash for the purposes of paying for the trip as the application deducts the cost of the trip directly from the customer’s bank account. In a context like South Africa with a high crime rate, security of payment is essential as holding cash is dangerous.

Directional selling by companies such as Discovery, which in this case involves the use of customer incentives agreed between Discovery and Uber to channel customers or traffic towards using Uber services, may also affect competition in the taxi industry enabling Uber service to tap into new passengers or market segments. This is akin to similar partnerships between Discovery and selected airlines operating in the South African market. Discovery, which provides various health and general insurance products, encourages its customers to use Uber with attached benefits and discounts.20 Uber’s partnership with Hilton Hotels around the world to provide hotel guests with a reliable means of transport to and from hotels, airports and restaurants, directly takes away customers that were traditionally served by metered taxis.21

Uber appears to have identified a gap in the taxi market and used innovation to gain competitive edge over incumbent traditional metered taxis. Incumbent operators have been forced to search for new solutions in order to respond to new forms of competition driven by technological developments. Competition policy has its objective to encourage competition not only on price, but through innovation, effort, consumer choice and quality. To the extent that the introduction of new services such as Uber encourages these outcomes, existing and new consumers are likely to benefit significantly. It is worth cautioning however, that directional selling and instances of below-cost pricing (as alleged) can lead to anti-competitive outcomes as demonstrated in several other markets such as air travel in the relationship between airlines and travel agents. Similar practices and the use of loyalty rebate schemes provided by airlines have been investigated by the competition authorities in the context of the South African market.22 It is important for those that have raised concerns regarding these services, and those regulators tasked with addressing these new challenges, to consider carefully the propensity of incumbent firms to use regulation and lobbying behaviour to protect their position in the market. On the other hand, there are clear socio-economic issues resulting from the displacement of traditional service providers through technology that cannot be ignored in a developing country context, and regulation at least has to ensure that conditions for competition (including licensing requirements) are consistent and fair across competing services where possible.

A PDF copy of this article can be found here.

Notes

- ‘Uber and the taxi companies: what’s the fight about?’ (8 July 2015). Htxt.africa.

- See note 1.

- ‘Uber plans to expand in South Africa’ (3 September 2015). News24hour.

- Debonis, M. ‘Uber car service runs afoul of D.C.Taxi Commission’ (11 January 2012). The Washington Post.

- Chafkin, M. ‘What makes Uber run’ (October 2015). Fast Company.

- Dunn, J. ‘Taxi driver who kept working during a 3,000 strong protest against Uber in Portugal is attacked in the street by angry cabbies’. (8 September 2015). MailOnline.

- Manuturi, V. ‘Uber on the Defensive After Ban From Bandung Streets’ (September 2015). JakartaGlobe.

- See note 1.

- National Economic Development and Labour Council. (2014). ‘Nedlac Report on the metered taxi implementation strategy’.

- Presence, C. ‘Law to be amended to regulate Uber’ (1 September 2015). Business Report.

- Rayle, L., Shaheen, S., Chan, N., Dai, D. and Cervero, R. (2014). App-based, On Demand Ride Services: Comparing Taxi and Ridesourcing Trips and User Characteristics in San Francisco. University of California Transportation Center (UCTA) Working Paper.

- Popper, B. ‘New York City's taxi industry insiders made an app to compete with Uber: A way to hail yellow cabs without the extra fee or surge pricing’ (27 August 2015). The Verge.

- Shezi, L. ‘A new cab-hailing app to rival Uber in South Africa’ (29 January 2015). Htxt.Africa; and Note 1.

- ‘Vancouver taxi companies who fought off Uber launch eCab app’ (September 2015). CBC News.

- See note 11.

- See note 1.

- See note 11.

- See note 1.

- See note 11.

- ‘Awesome discounts if you pay for your Uber trips with your DiscoveryCard’. Discovery website.

- Ayre, J. ‘Uber Partnering With Hilton To Streamline Travel Experience’ (September 2015). EVObsession.

- Ncube, L. 'Competition and regulatory issues in the civil aviation sector'. Aviation Industry Growth and Safety Conference, 4 November 2014.