EXCESSIVE PRICING IN THE GLOBAL PHARMACEUTICAL INDUSTRY

In the developing world, disease and poverty are interdependent making access to essential medicines at affordable prices even more critical. 80% of the two billion people worldwide without access to essential medicines live in low income countries. As such, competitive rivalry in the pharmaceutical industry can improve access to medicines by reducing prices and through motivating brand companies to challenge existing patent drugs and create new and improved medicines. Furthermore, upon expiration of patent drugs, competition encourages generic companies to provide less expensive alternatives of medicines.

THE IMPORTANCE OF ACCESS CONDITIONS IN VERTICAL MERGERS: VEHICLE ASSEMBLY IN KENYA

On 29 August 2017, the Competition Authority of Kenya (CAK) approved with conditions the proposed acquisition of Associated Vehicle Assemblers Limited (AVA) by Simba Corporation Limited (Simba Corp). The approved merger sees the acquisition of an additional 50% of the shares in AVA which were previously controlled by Marshalls East Africa Limited (Marshalls).

HEINEKEN DEVELOPING A TASTE FOR LOCAL CRAFT BREWERS

One of the world’s largest brewing houses, Heineken, has taken a step towards a larger share of the South African beer market with the acquisition of the local black owned craft brewer, Soweto Gold, in October 2017. This development comes just months after Heineken bought out the Stellenbosch-based brewery, Stellenbrau. The mergers mean that the brands can now be marketed to a global customer base. While this may be good for the respective owners of the acquired firms, the transactions reflect the challenges faced by Soweto Gold and other small brewers in accessing routes to market on their own.

CARTELS INVESTIGATED IN SOUTH AFRICA: POSSIBLE IMPACT IN THE REGION?

Most countries in Southern Africa are net importers of products from South Africa and are therefore likely to be subject to South African cartels. Imports from South Africa cut across sectors including food, capital equipment, construction materials, energy, plastics and chemical products. Moreover regional markets are closely linked through the presence of South African companies in the rest of the region. This article expands on an earlier article in this Review on the possible impacts of some of the South African cartels on the region, as part of CCRED’s monitoring of competition case developments and the evolution of enforcement in the region.

EXCLUSIONARY ABUSE IN THE ROOIBOS LIMITED CASE

The local rooibos market in South Africa comprises 8 large processing firms which account for approximately 90% of the market, with Rooibos Limited controlling 60% of the market. Similar to other processing firms, Rooibos Limited purchases large quantities of tea from commercial farmers and processes it into bulk tea which is subsequently sold to packaging firms to pack into finished products. A case against Rooibos Limited has recently been referred to the Competition Tribunal alleging exclusionary abuse of dominance in contravention of section 8(d)(i) of the Competition Act.

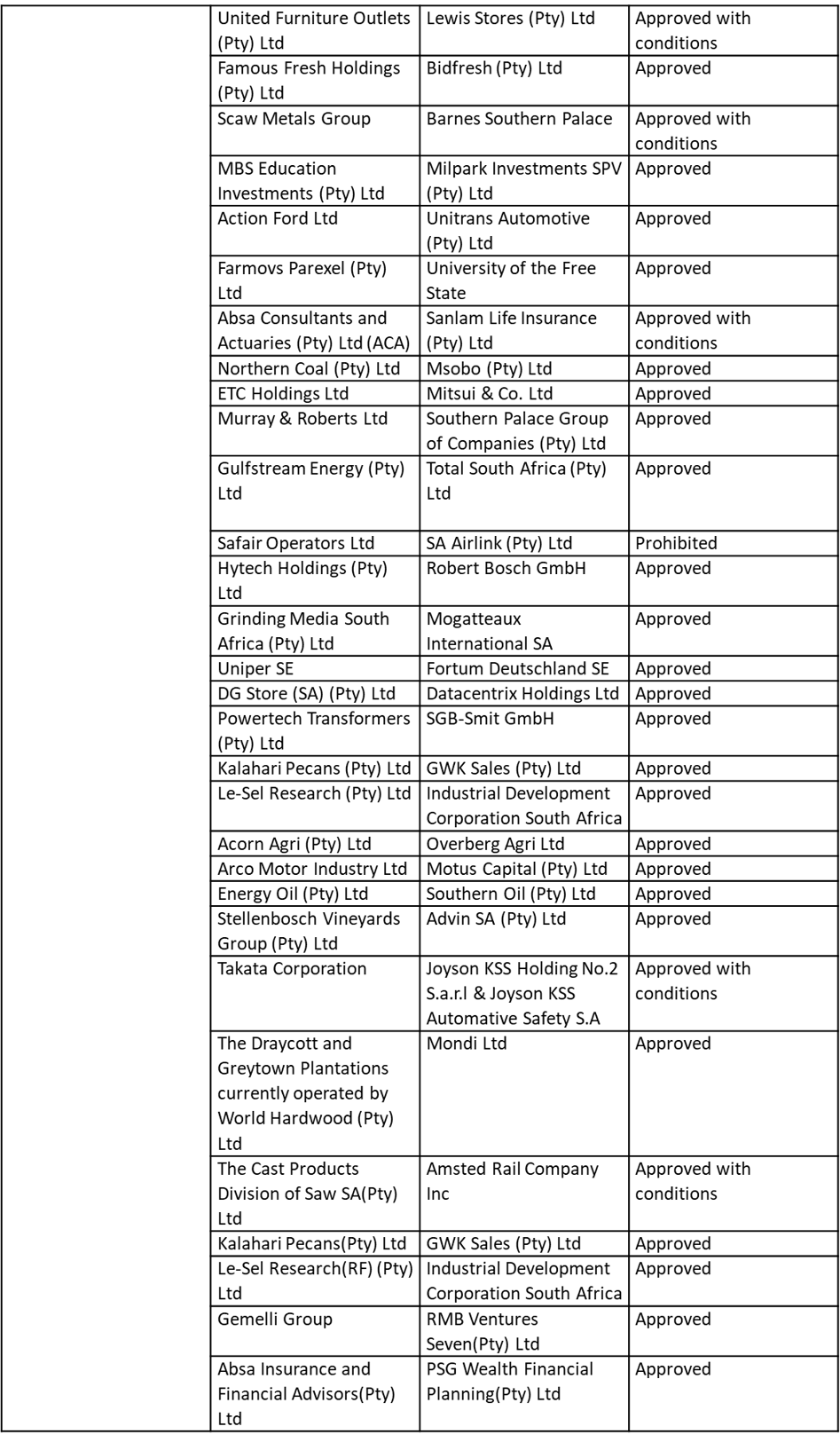

QUARTERLY COMPETITION CASE UPDATE - DECEMBER 2017

The Case for Patient Capital: Small Business Funding in South Africa

Small and Medium Enterprises (SMEs) are key drivers of inclusive growth in the South African economy, contributing about 55% to the gross domestic product, while their contribution towards employment is as high as 60%. In addition, small firms and new entrants enhance competition within different economic sectors, resulting in lower prices and greater variety for consumers, as well as dynamic and productive efficiencies.

Recent Cartel Penalised in South Africa: Possible Impacts in the Region?

The South African Competition Commission has been very successful in uncovering cartels, with a large number of settlements over the past 10 years. It should be noted that settlements typically involve an admission on the part of the companies involved. Given the regional scope of many companies’ activities across southern Africa this begs the question as to whether these cartels affected neighbouring countries and should also be prosecuted in these countries.

South Africa's Public Transport Market Inquiry: Integrating Modes

The Competition Commission of South Africa’s land-based public passenger transport market inquiry, which commenced in June 2017, addresses a range of questions including issues with intermodal transport links. The inquiry relates to excessive short distance passenger transport fares charged by buses, peak season long distance bus fares, operational subsidies disadvantaging operators that are not subsidised, and restricting particular providers to operate in specific areas and routes. The issues to be considered cut across several public transport modes. The inquiry coincides with the Gauteng provincial government’s plan to expand its high speed train, Gautrain, into two of Gauteng’s largest townships.

Key Issues in Developing Cosmetics, Soaps, and Detergents Value Chains - South Africa and Zambia

Firm competitiveness can be understood as the ability to provide products and services at least as efficiently and effectively as competitors. At the industry level, international competitiveness is the ability of domestic firms to achieve sustained success against foreign competitors such as in terms of unit labour costs and relative productivity. Competitiveness is critical if a country’s firms are to take advantage of the opportunities presented by the regional and international economy. Furthermore, it can stimulate industrialisation and economic growth which subsequently promotes job creation, higher productivity and innovation.

What can we Learn from the First COMESA Restrictive Business Practice Case?

The Implications of Global Consolidation in the Seed Industry

The world population is expected to reach ten billion by 2050, which has implications for food security in the context of climate change. In the recent $43 billion acquisition of Syngenta, a global seed company, by ChemChina, a chemicals company, the CEO of ChemChina notes that the merger was driven by China’s need to secure future food supply, given the country’s history of famines. This strategy highlights the importance of access to seeds as a key input in agricultural production. This article looks at the implications of increased consolidation in the global seed industry on access to seed and food security.

COMESA CC Approval of the BIH and Carlsberg Beer Merger

In April 2017, the COMESA Competition Commission (CCC) conditionally approved a large merger between Brasseries Internationales Holdings (BIH) Ltd and Carlsberg Malawi Ltd (Carlsberg). BIH is the holding company of Castel Group, a French beverages company. The second party to the merger, Carlsberg, is a beverages manufacturer participating solely in the Malawian market in Africa. The merger spans four countries: Ethiopia, Malawi, Madagascar and the Democratic Republic of Congo.

DSTV Media Sales: Price Fixing, Market Power and Two-Sided Markets

DStv Media Sales (Pty) Ltd (DMS) was recently found to have been involved in anti-competitive behaviour and has admitted to price fixing as well as fixing trading conditions. This comes after an investigation by the Competition Commission of South Africa which commenced in November 2011 where it was concluded that, through a company called Media Credit Co-Ordinators (MCC), associated media agencies were offered discounts for early settlement of their accounts of 16.5% for payments made within 45 days whereas non-member agencies were only given a 15% discount.

Quarterly Competition Case Update - August 2017

Understanding economic activity in Johannesburg

Regulatory standoff between Potraz and Mobile Network Operators in Zimbabwe

The Postal and Telecommunications Regulatory Authority of Zimbabwe (POTRAZ) set floor prices for data and voice services including promotional packages, effective in January 2017. The floor prices are set at $0.12 per minute for voice services, and $0.02 per megabyte for data. Initially data prices were below $0.01 per megabyte.

Competition Authority of Kenya (CAK) rules on USSD Pricing

The Competition Authority of Kenya has ordered all mobile money service providers, including Safaricom, to disclose all mobile money service fees payable by consumers for USSD (unstructured supplementary service data) based transactions.

Reflection on the Arcelormittal settlement

On 17 November 2016, the South African Competition Tribunal (“Tribunal”) confirmed a settlement agreement reached between the Competition Commission and ArcelorMittal South Africa Ltd (AMSA) with regards to AMSA’s involvement in the long steel and scrap metal cartels. The settlement covered four complaints against AMSA, three of which involved collusion in flat steel, long steel and scrap metal markets and the other on excessive pricing of flat steel products.