Abuse of dominance in the tea market

Farisai Chin'anga

The local rooibos market in South Africa comprises 8 large processing firms which account for approximately 90% of the market, with Rooibos Limited controlling 60% of the market. Similar to other processing firms, Rooibos Limited purchases large quantities of tea from commercial farmers and processes it into bulk tea which is subsequently sold to packaging firms to pack into finished products. A case against Rooibos Limited has recently been referred to the Competition Tribunal alleging exclusionary abuse of dominance in contravention of section 8(d)(i) of the Competition Act. The referral follows an investigation by the Competition Commission of South Africa in which Rooibos Limited was found to be using exclusionary contracting strategies in order to foreclose the supply of tea to other tea processors. The firm entered into 5-year contracts with the commercial farmers of rooibos tea, in which the farmers agreed to supply specified volumes of rooibos tea in 2014. Prior to 2014, Rooibos Limited had sourced rooibos tea from commercial farmers through 1-year contracts. Additionally, the firm offered its production research output to farmers on the condition that farmers would in turn supply it with up to 50% of their produce. These strategies allegedly impacted negatively on rival firms as Rooibos Limited secured a large proportion of the tea available in the rooibos tea processing market.

Overview of the case

Under section 8d(i) of the Competition Act, Rooibos Limited’s conduct of entering into long-term supply contracts with commercial farmers is alleged to be exclusionary and anti-competitive as it could impede rival processing firms from expanding at the processor level of the rooibos tea value chain. This is consistent with a foreclosure theory of harm in which an incumbent firm deters effective competition through undermining the ability of rival firms to attract suppliers. Rooibos Tea is not in ubiquitous supply in South Africa such that securing sufficient volumes of tea for processing is important in the market in which scale economies are critical. Rooibos is primarily produced in a small geographical area in the Cederberg and Sandveld areas of the Western Cape and the Bokkeveld area of the Northern Cape. Although there are approximately 350 to 500 rooibos farmers in South Africa, only a limited number of farmers in the upstream market produce the majority of the total bulk tea supplied to processing firms.

Additionally, offering production research output in exchange for a stipulated supply of rooibos tea from commercial farmers was also alleged to be exclusionary and potentially detrimental to competing rooibos processing firms. The production research output presented a strong incentive for farmers to supply rooibos tea to Rooibos Limited as the research contributes to enhancing the overall quality, yields and farming methods. The research conducted includes a focus on issues such as soil health, optimal fertilizer usage, crop rotation and the use of chemicals. As such, there are efficiencies which need to be balanced against any anticompetitive effects of the alleged conduct.

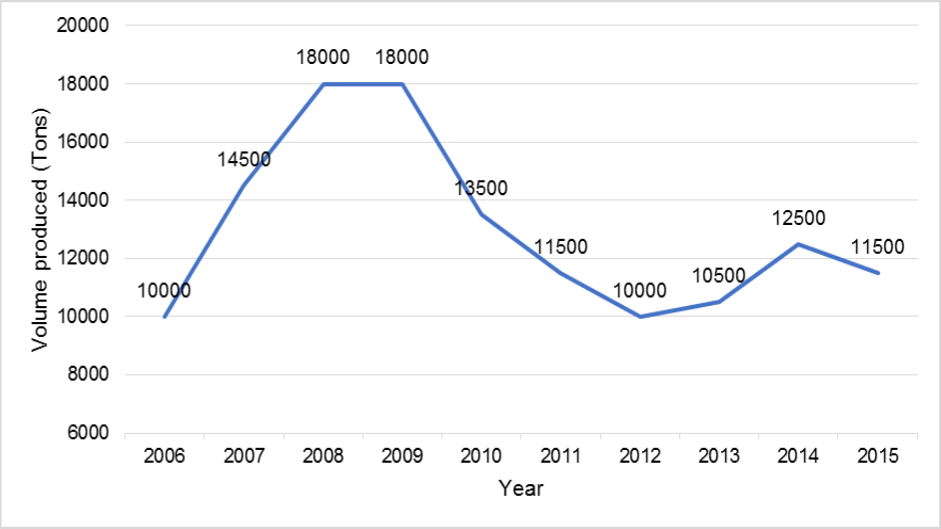

The overall production of rooibos from commercial farmers decreased by 36% between the years 2009 and 2015. This may have contributed to the change in Rooibos Limited’s strategy to a focus on tying up a large share of farmers’ output for its own processing requirements. Figure 1 below illustrates that production gradually dropped from 18 000 tons in 2009 to 10 000 tons in 2012, the lowest volume recorded since 2006. In spite of the 25% increase recorded between 2012 and 2014, production declined once more by 8% between 2014 and 2015. Some rooibos commercial farmers have attributed the decline in yields to climate change, with erratic rainfall and droughts being experienced in the Western Cape province over the past years.

Given the above constraints, it seems likely that Rooibos Limited would find it beneficial to secure the supply of bulk tea for processing especially during periods of low yields and output. By extending the duration of contracts and tying up a large proportion of suppliers’ output, rival firms are effectively foreclosed from accessing supply, raising their costs such that they cannot compete effectively in the market. Because of the fact that Rooibos Limited is a dominant firm, it is positioned as a critical customer for suppliers, which is reinforced by the benefits suppliers obtain from its various research initiatives. These efficiencies are required to be balanced against the likely harm to rivals. The use of strategic contracting locked in significant volumes of rooibos tea, whereas rival firm purchases remained stagnant or declined. Prior to that, volumes of rooibos purchased by Rooibos Limited were in severe decline.

Implications for rival processing firms

The use of exclusive long-term contracts and production research output by Rooibos Limited as an incentive induced commercial farmers not to deal with other processing firms. This had the effect of locking in key suppliers of unprocessed rooibos tea whilst securing significant volumes of the upstream input in the market. As a result, the price of the upstream input increased which in turn increased the costs of other rooibos processing firms, in line with theory in this regard. Of course, there are benefits to farmers from the research and the security of offtake guaranteed by the contracts which need to be considered.

There is potential for growth of rooibos exporters through supplying international markets. The rooibos market in the United Kingdom has increased significantly by 300% between 2006 and 2015, with rooibos accounting for 8.1% of the herbal tea total consumption in the United Kingdom valued at $US179 million. In the current economic climate in South Africa where there is an emphasis on addressing a history of concentrated markets and opening up markets for greater contestation, it is especially important that agreements such as those described herein are treated with a high level of scrutiny. If rival firms are limited through strategic conduct from contesting markets, their ability to expand and develop capabilities to compete in domestic and global markets is significantly undermined to the detriment in the long term of the economy as a whole.

Figure 1: Production of Rooibos tea in South Africa, 2006 - 2015

Source: South African Rooibos Council (2016)