Part of the focus of the proposed amendments to the Competition Act is on preventing creeping concentration. Creeping concentration results from a series of mergers and acquisitions that individually do not raise market power substantially, but do so collectively. Firms can increase market share through mergers and acquisitions, and consequently increase market power and concentration in markets.

Quarterly Competition Case Update - May 2018

HEINEKEN DEVELOPING A TASTE FOR LOCAL CRAFT BREWERS

One of the world’s largest brewing houses, Heineken, has taken a step towards a larger share of the South African beer market with the acquisition of the local black owned craft brewer, Soweto Gold, in October 2017. This development comes just months after Heineken bought out the Stellenbosch-based brewery, Stellenbrau. The mergers mean that the brands can now be marketed to a global customer base. While this may be good for the respective owners of the acquired firms, the transactions reflect the challenges faced by Soweto Gold and other small brewers in accessing routes to market on their own.

QUARTERLY COMPETITION CASE UPDATE - DECEMBER 2017

Quarterly Competition Case Update - August 2017

QUARTERLY COMPETITION CASE UPDATE: MERGERS, ACQUISITIONS AND COMPETITION CASES - NOVEMBER 2016

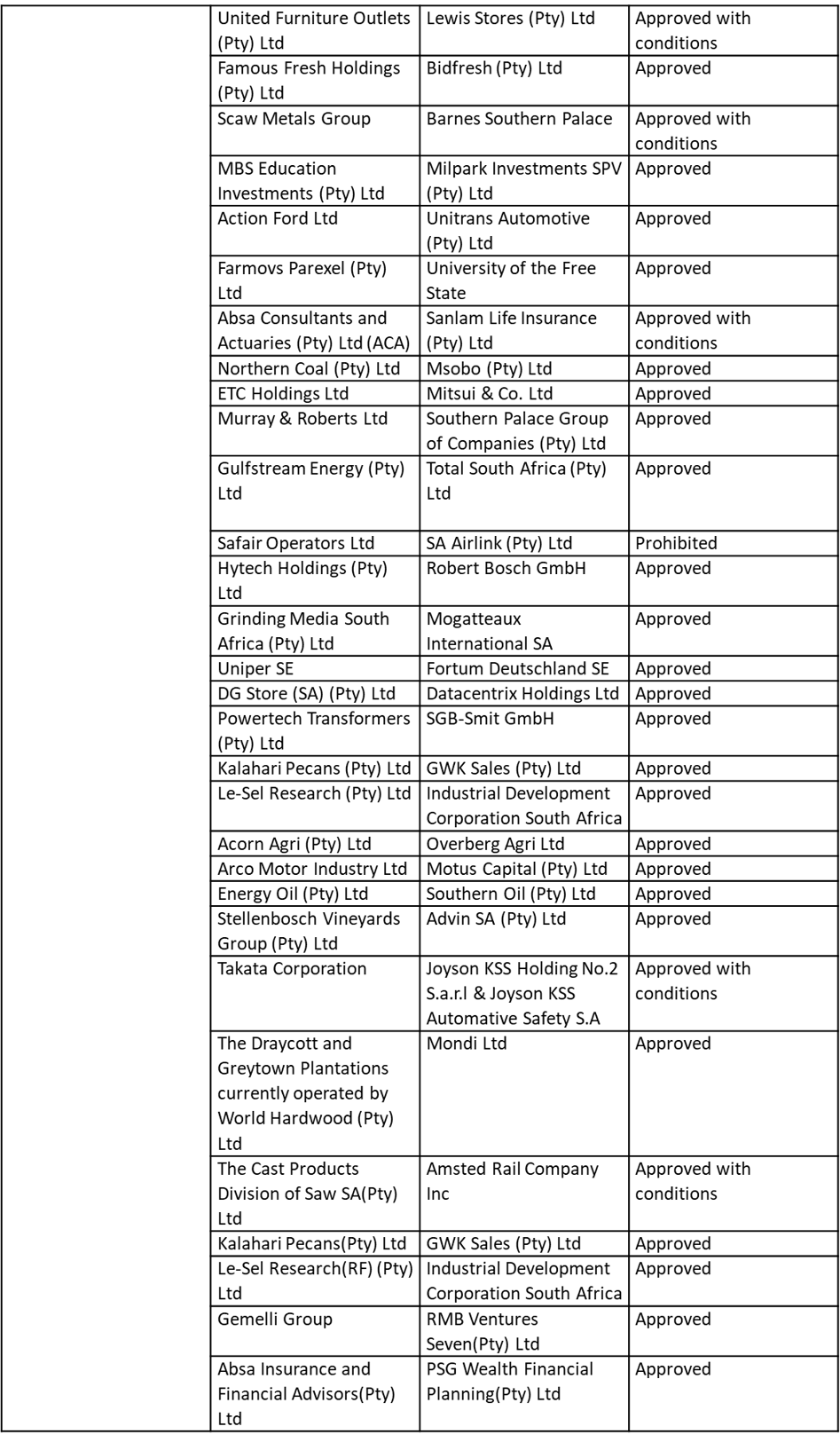

A summary of some of the major mergers, acquisitions and enforcement cases in the region.